The Dow Jones Industrial Average jumped more than 1% while the Nasdaq Composite struggled to stay above breakeven on Friday, finishing 61 basis points higher, as markets head into a three-day weekend. (That’s right, don’t forget to keep your screens off on Monday, unless you just want to get in a little extra chart studying.) Speaking of which, here are the five top stocks to trades for when the markets reopen Tuesday:

Deere (DE)

Click to Enlarge Shares of Deere (NYSE:DE) came under slight pressure Friday, falling just 2.1% despite missing on earnings expectations and beating on revenue estimates. With shares hovering right near $165 resistance, Deere would’ve needed a strong quarter to launch its stock into breakout mode.

Now pulling back, we have to see where support comes into play. Short of Friday marking the short-term low, a test of the 50-day seems likely.

If we get a broader market correction — and perhaps some trade-war worries — we could get DE stock down into this $145 to $148 area. That puts uptrend support, and the 200-day moving average, into play.

That would give investors a low-risk long opportunity should they find DE attractive.

Compare Brokers

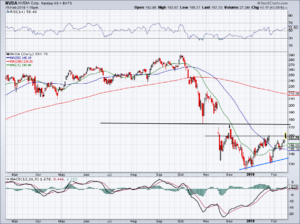

Nvidia (NVDA)

Click to Enlarge Shares of Nvidia (NASDAQ:NVDA) were up big in after-hours trading Thursday evening. The company’s earnings results and guidance gave bulls confidence, running shares up over $170. That was a key level in the stock though — and one we outlined earlier this week.

With shares up just over 2% now, confidence isn’t all that high and the move isn’t all that impressive as NVDA fades off its highs. Bulls want to see to the stock stay over the 21-day moving average now. Below and the 50-day is on the table and possibly a test of uptrend support down below $140.

If the 21-day holds, a run up to $174 is possible. Above that and $200 becomes a possibility again.

Compare Brokers

Canopy Growth (CGC)

Click to EnlargeLike Nvidia, the modest post-earnings rally in Canopy Growth (NYSE:CGC) isn’t exactly inspiring the bullish spirits on Wall Street. Shares continue to hold up over this $45 to $46 level, as well as uptrend support and the 21-day moving average.

So long as that’s the case, CGC can technically move higher. If it closes above $50, it could trigger a move up to the prior highs near $60. Below the 21-day moving average, though, and Canopy Growth stock may need some time to reset.

Compare Brokers

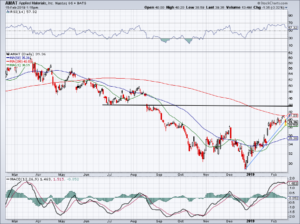

Applied Materials (AMAT)

Click to EnlargeA rally from sub-$30 to more than $40 per share right into the 200-day moving average put bulls in a poor risk-reward situation with Applied Materials (NASDAQ:AMAT). Particularly with the company reporting earnings.

Despite a top and bottom line beat, AMAT stock pulled back after somewhat disappointing guidance. That said, shares are bouncing nicely off the 21-day moving average. Considering the run-up prior to earnings, this price action isn’t all that bad.

Aggressive bulls can buy now and use a close below the 21-day as their stop. Conservative bulls can buy on a potential breakout over the 200-day moving average.

Bears have a play too. If they didn’t like the quarter and don’t like the stock, they can consider shorting AMAT with a stop-loss on a close over the 200-day. More conservative bears can wait for a break of the 21-day.

If they get it, they can look to ride AMAT down to the 50-day moving average.

Compare Brokers

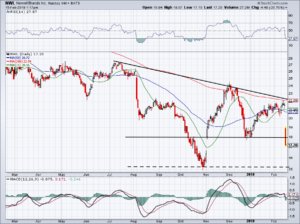

Newell (NWL) and XPO Logistics (XPO)

Click to Enlarge Newell Brands (NYSE:NWL) (top) beat on earnings but missed on revenue estimates for the fourth quarter. Making matters worse, guidance disappointed.

In all, the report sent shares reeling, down more than 20% Friday. As such, NWL stock remains a no-touch. Its plunge below $18 thrusts it into no man’s land and puts the $15 lows on the table.

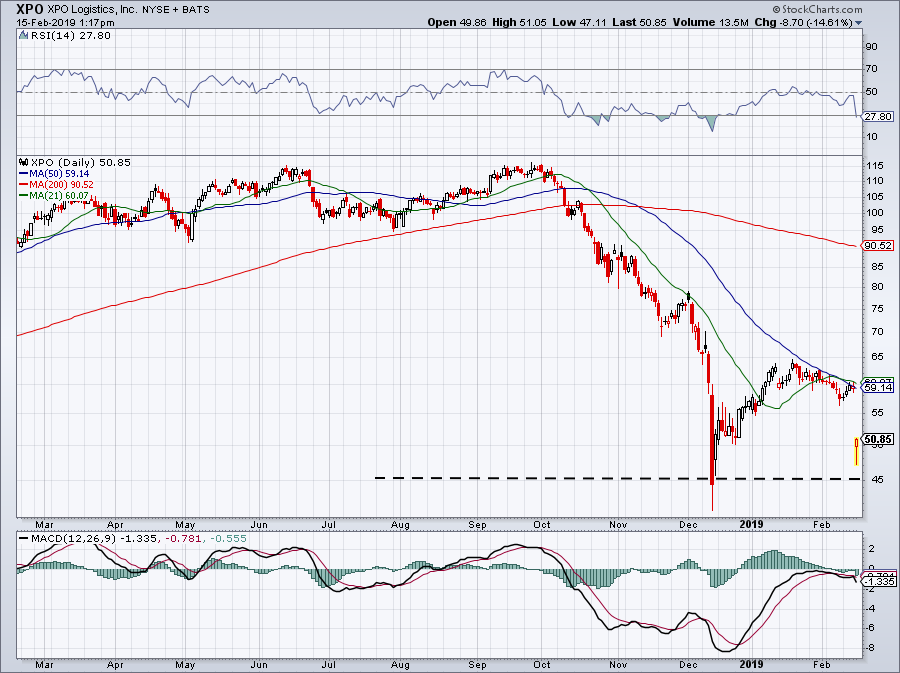

This one remains a disaster, just like XPO Logistics (NYSE:XPO), below.

A top and bottom line earnings miss sent XPO spiraling lower Friday, falling more than 12%.

While XPO is rallying off the lows, it’s in no man’s land, too. Like Newell, its 52-week lows are on the table of possibilities, and it’s hard to have much trust in this name until it can get above its 21- and 50-day moving averages.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Ken

No comments:

Post a Comment